Even as President Obama tried to give an upbeat attitude last night in his SOTU message, one economist has made a prediction that does not bode well whatsoever for economic recovery: the housing market mat not recover for a decade. If this is true, many homeowners will continue to have negative equity and will be inclined to walk away and allow homes to go to foreclosure, All of which will pressure further drops in housing values. And the downward spiral will continue. What's driving it all? Banks are not lending and people cannot get financing even as banks continue to give their top officers obscene salaries and bonuses. The situation is seriously f*cked up and unless Obama/Congress do something to force renewed lending - both in the residential realm and in commercial lending, business simply will not pick up. With a law firm that does a great deal of real estate work, I see daily the impact of the drying up of lending as home buyers are left not being able to secure financing. In the commercial realm, other than my Indian clients and others of foreign descent who have family overseas that can as aid them with money infusions, it is a very bleak picture. Here are highlights from a Washington Post story:

Even as President Obama tried to give an upbeat attitude last night in his SOTU message, one economist has made a prediction that does not bode well whatsoever for economic recovery: the housing market mat not recover for a decade. If this is true, many homeowners will continue to have negative equity and will be inclined to walk away and allow homes to go to foreclosure, All of which will pressure further drops in housing values. And the downward spiral will continue. What's driving it all? Banks are not lending and people cannot get financing even as banks continue to give their top officers obscene salaries and bonuses. The situation is seriously f*cked up and unless Obama/Congress do something to force renewed lending - both in the residential realm and in commercial lending, business simply will not pick up. With a law firm that does a great deal of real estate work, I see daily the impact of the drying up of lending as home buyers are left not being able to secure financing. In the commercial realm, other than my Indian clients and others of foreign descent who have family overseas that can as aid them with money infusions, it is a very bleak picture. Here are highlights from a Washington Post story: *

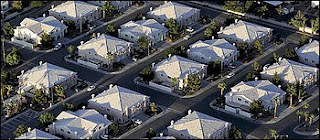

Even as the housing market shows signs of improvement, including in new data released Tuesday, economists warn that it could take up to a decade for many homeowners to regain equity in their homes, while some people in the hardest-hit regions of the country may not see a recovery during their lifetime.

*

Home prices have fallen 30 percent since reaching their peak in 2006, and many economists think they will take another tumble this year as more foreclosures pile on the market. The pace of recovery will vary throughout the country, with homes in the most battered markets taking the longest to regain value. Meanwhile, millions of homeowners who are "underwater" -- owing more on their mortgages than their homes are worth -- face years of negative equity that puts them at a higher risk of foreclosure.

"What are we going to do down the road when people who should have been saving for retirement, or college funds, are spending that money instead staying current on their underwater home?" said Brent T. White, a University of Arizona law school professor who has studied underwater borrowers.

*

Economists worry that the housing market could stumble later this year when government measures to boost sales, including ultra-low interest rates and a tax credit for home buyers, expire. "We're just not convinced that the housing market can stand on its own two feet without the fiscal support of the tax credit," said Paul Dales, an economist for Capital Economics, a research firm.

*

Even after the housing market stabilizes, it will take years for some owners to see the value of their homes appreciate. About 25 percent of homeowners owe more than their home is worth, according to data from First American CoreLogic, a research firm.

*

"If the question is how long will it take for prices to recover to the peak, it will be longer than before simply because prices fell by more," Lawler said. And in some parts of the country, the answer may be never, he said.

*

As goes housing, so goes the economy. Meanwhile, Wall Street hands out billions in bonuses rather than making loans to homeowners and struggling small business. Again, things are seriously f*cked up.

Even as the housing market shows signs of improvement, including in new data released Tuesday, economists warn that it could take up to a decade for many homeowners to regain equity in their homes, while some people in the hardest-hit regions of the country may not see a recovery during their lifetime.

*

Home prices have fallen 30 percent since reaching their peak in 2006, and many economists think they will take another tumble this year as more foreclosures pile on the market. The pace of recovery will vary throughout the country, with homes in the most battered markets taking the longest to regain value. Meanwhile, millions of homeowners who are "underwater" -- owing more on their mortgages than their homes are worth -- face years of negative equity that puts them at a higher risk of foreclosure.

"What are we going to do down the road when people who should have been saving for retirement, or college funds, are spending that money instead staying current on their underwater home?" said Brent T. White, a University of Arizona law school professor who has studied underwater borrowers.

*

Economists worry that the housing market could stumble later this year when government measures to boost sales, including ultra-low interest rates and a tax credit for home buyers, expire. "We're just not convinced that the housing market can stand on its own two feet without the fiscal support of the tax credit," said Paul Dales, an economist for Capital Economics, a research firm.

*

Even after the housing market stabilizes, it will take years for some owners to see the value of their homes appreciate. About 25 percent of homeowners owe more than their home is worth, according to data from First American CoreLogic, a research firm.

*

"If the question is how long will it take for prices to recover to the peak, it will be longer than before simply because prices fell by more," Lawler said. And in some parts of the country, the answer may be never, he said.

*

As goes housing, so goes the economy. Meanwhile, Wall Street hands out billions in bonuses rather than making loans to homeowners and struggling small business. Again, things are seriously f*cked up.

No comments:

Post a Comment